Newsletter Subscribe

Enter your email address below and subscribe to our newsletter

One of the big decisions an American individual can make and it has a big impact on their financial well-being is choosing one of the best banks in the US. It is crucial to find a bank that fits your needs and offers competitive rates and features, no matter you are looking for checking for […]

One of the big decisions an American individual can make and it has a big impact on their financial well-being is choosing one of the best banks in the US. It is crucial to find a bank that fits your needs and offers competitive rates and features, no matter you are looking for checking for a saving account, checking account or other banking services.

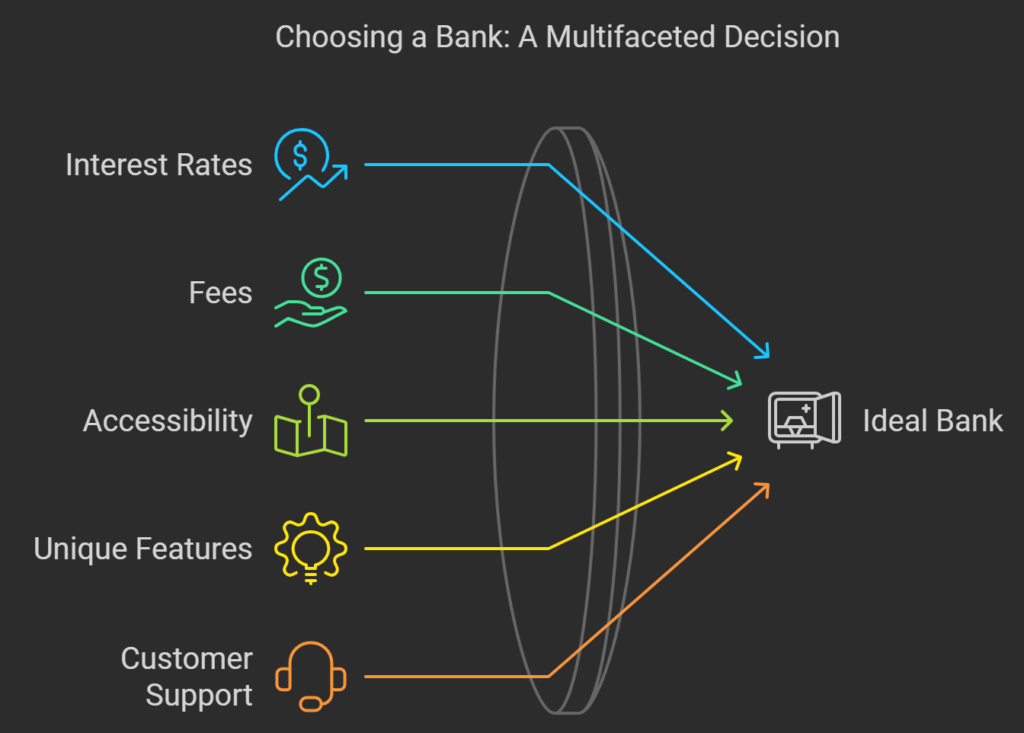

In this article, we will review some of the top banks in the US to help you pick the best bank for your needs. When choosing a bank, consider factors such as interest rates, fees, accessibility, and customer service. There are several types of banks to consider:

In the following sections, we’ll look at some of the best banks in different categories:

We’ll provide details on interest rates, fees, accessibility and customer service to help you pick the right fit. With this article, you can confidently choose a bank to meet your financial needs in 2024.

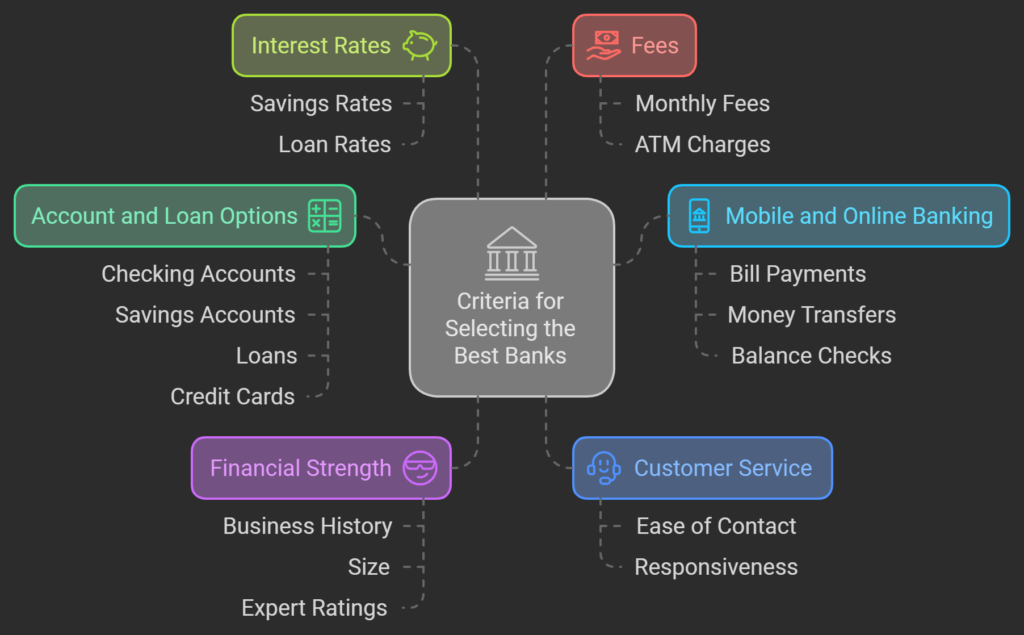

We looked at several important things to find the best banks this year. Here’s a breakdown of what really matters when choosing a bank.

JPMorgan Chase provides banking services to millions of people across America and around the world. They offer many types of accounts and loans to suit different needs.

With thousands of locations and online banking too, customers have easy access however they want to bank. JPMorgan Chase is considered one of the best banks for mortgage loans in the US, offering a variety of home loan options with competitive rates and flexible terms

JPMorgan Chase has checking and savings accounts, credit cards, mortgages, auto loans, and more. Whether you need personal or small business services, they can help. They also help people and groups invest their money through financial advisors.

Thanks to its large network of branches and cash machines (ATMs), JPMorgan Chase makes banking convenient. No matter if you’re in a big city or small town, you’ll likely find one nearby. This allows customers to deposit money, withdraw cash, or do other transactions in person or on their own with an ATM.

In today’s digital world, JPMorgan Chase keeps up with technology. Their mobile app lets you check balances, pay bills, transfer funds, and deposit checks with your phone. You can also bank online from your computer. The bank continuously improves these tools to match customers’ changing needs.

Whether you’re a person or company, JPMorgan Chase supports you. Personal services help everyday people. Business solutions aid small shops and large corporations. This helps the bank attract many different types of clients.

With top-tier customer service, JPMorgan Chase is recognized as one of the best banks in the US for customer service, ensuring clients receive prompt and effective support whenever needed

As an international company, JPMorgan Chase serves clients in over 100 countries worldwide. This gives them experience investing money and managing assets on a large scale. Their worldwide operations make them a leader in the finance industry.

With its all-around offerings, network of locations, and digital-first approach, JPMorgan Chase stands out as a reliable choice for banking in 2024.

Bank of America uses new technology to help customers manage their money. Over 37 million people use the bank’s mobile app. The app lets you deposit checks, pay bills and track spending right from your phone. Recently, the app started offering “virtual debit cards.”

This lets customers make purchases online right away, without waiting for a plastic card in the mail. The app also has an assistant named Erica. Erica can answer questions, help make a budget, and show where your money is going each month.

Bank of America provides a wide range of financial products. They have checking and savings accounts for personal or business use. Customers can also get loans, credit cards, and investing help. This lets each person find the right services for their needs.

Bank of America is one of the best banks in the US for small businesses, providing tailored business checking accounts, loans, and merchant services to meet the diverse needs of entrepreneurs. Whether saving for a home or running a small business, the bank has options.

Bank of America wants customers to feel supported. They ask for feedback to make services better. The bank has won awards for its customer service. Employees work hard to quickly answer questions and solve problems.

Giving back is also important. The bank invests in programs helping local areas. One example is Breakthrough Lab. This program helps startup companies from underrepresented groups with mentoring and resources. Bank of America has also committed over $500 million to support women- and minority-owned businesses.

Through continued digital improvements, financial choices, excellent service, and community support, Bank of America leads the industry as a trusted banking partner. Bank of America also supports veterans, making it one of the best banks for veterans in the US by offering specialized financial products and services tailored to their unique needs

Wells Fargo offers many convenient ways to bank. The company has over 8,000 branches across the country where customers can get face-to-face help from bankers. Customers can also use over 13,000 ATMs to withdraw or deposit cash without paying fees.

Wells Fargo provides phone support and online chat to answer questions. A mobile app allows people to check balances, transfer money, and deposit checks on smartphones. This helps ensure customers can get assistance whenever and however they need it.

In addition to customer service, Wells Fargo supplies a broad selection of financial products. People can open checking and savings accounts suited to their needs. The bank also offers credit cards, home and auto loans, and investment services. This allows individuals and businesses to take care of all their banking in one convenient place.

The mobile app continues improving with new features like sending money to friends and family using Zelle. App users can also set up alerts to notify them about account activity. Wells Fargo works to make banking simpler through innovative technology on smartphones. Both Apple and Google give the app high ratings showing it is user-friendly.

In the past, Wells Fargo faced issues with opening accounts without permission. Now the company focuses on transparency and accountability. Strict new rules aim to prevent problems and ensure ethical practices. Wells Fargo understands rebuilding trust is important. It is committed to serving customers well into the future.

Citibank is one of the best banks for people who travel or do business around the world. It has offices in over 160 countries, more than any other U.S. bank. This extensive global network lets customers easily use their Citibank accounts almost anywhere on the planet.

With locations on every inhabited continent, Citibank makes it simple for clients to access services whether they’re across town or in a foreign country. The bank has branches and ATMs in cities large and small.

No matter where business or leisure takes you, there will likely be a Citibank nearby. This widespread physical presence is complemented by digital banking options that allow managing money on the go via mobile devices and online platforms.

Citibank offers top-tier financial solutions for customers with significant assets to oversee. The bank’s wealth management division employs teams of dedicated advisors. These professionals take the time to understand each client’s unique situation and long-term goals.

Advisors provide guidance on diversifying investment portfolios, tax planning, risk management, estate strategies, and more. Through personalized attention, Citibank ensures the complex needs of affluent clients are exceedingly well-met.

Citibank has international travelers in mind with special features like the Citibank Global Wallet. This innovative account permits holding balances in over 30 currencies with no conversion or transaction fees when paying for goods and services abroad. The bank also offers robust travel notifications and emergency card cancellation through its highly-rated mobile app.

Citibank stands out as one of the best banks for international travel in the US, thanks to its extensive global network, no foreign transaction fees on certain accounts, and services tailored for travelers. These tools give travelers extra reassurance that their accounts and cards remain safe even while miles from home.

Customers consistently report high satisfaction with Citibank’s customer service. The user-friendly app allows checking balances, paying bills, depositing checks, transferring funds between accounts, and more with just a few taps.

Live phone and online chat support are available 24/7 in multiple languages. Whether contacting representatives directly or exploring self-service options, Citibank strives to make managing money as straightforward as possible.

Ally Bank has become one of the most popular online bank choices in the U.S. due to its emphasis on convenience, competitive rates, and lack of fees. By handling all services digitally, Ally appeals to those who enjoy the flexibility of mobile and online banking.

As the first bank to operate entirely online and mobile, Ally lets customers manage their finances using the device of their choice. Whether on a computer, tablet or smartphone, the Ally website and mobile app allow quick access to all essential banking tasks.

Users can check account balances, view transaction histories, transfer funds between accounts, deposit checks remotely by taking photos with their phone camera, and more. This high level of convenience is ideal for busy individuals who want the freedom to bank anywhere, anytime without visiting a physical branch location.

One of Ally’s strongest selling points is its superlative interest rates on savings accounts. The annual percentage yield (APY) offered by Ally is often higher than rates at traditional brick-and-mortar banks. This means customer savings have a better chance to grow over time without fees getting in the way. Ally also has no minimum balance requirements, so account holders can start small without worry.

Ally Bank is recognized as one of the best banks for high-yield savings accounts in the US, boasting interest rates that often surpass those of traditional brick-and-mortar banks. The combination of high yields and no fees make Ally an excellent choice for those focused on watching their savings increase.

In addition to competitive rates, Ally stands out for its lack of account fees. Customers enjoy absolutely no monthly maintenance or service charges on checking or savings accounts. This fee-free approach is appealing to individuals who want straightforward banking without unexpected deductions. Ally also refunds any ATM usage fees charged by other institutions nationwide.

The bank even issues debit cards without foreign transaction fees for added convenience when traveling abroad. Ally Bank stands out as one of the best banks with no fees in the US, offering both checking and savings accounts free from monthly maintenance and service charges.

Ally’s entirely digital focus has made it hugely popular among technologically-savvy consumers. In addition to core banking functions, Ally’s mobile app offers budgeting tools, person-to-person payment options like Popmoney, and the ability to open new accounts quickly online.

Younger customers especially appreciate Ally’s innovative features and clean, intuitive interface designed for phones and tablets. The bank’s modern approach to banking technology continues drawing in new digital-first users.

U.S. Bank has established itself as one of the premier regional banks in the United States. It strives to deliver an outstanding customer experience while meeting all of its customers’ financial needs through a full suite of personal and business banking solutions.

Customer service is a top priority at U.S. Bank. The bank has received widespread recognition for the excellent assistance provided by its customer service representatives. Whether customers need help over the phone, online, or in person at a local branch, U.S. Bank makes it easy to get any questions answered quickly and satisfactorily by knowledgeable staff.

The U.S. Bank Mobile App also allows busy customers to manage their accounts and get support 24/7 from their smartphone or tablet. With customer service available through multiple convenient channels, U.S. Bank ensures all customers’ banking needs are addressed efficiently.

In addition to exemplary service, U.S. Bank offers a full suite of banking products tailored for both personal and commercial clients. Individuals have many account and loan options like checking, savings, credit cards, home mortgages, and auto loans to choose from depending on their unique financial situations and goals.

Meanwhile, businesses can rely on U.S. Bank to support their needs through commercial banking solutions, treasury management, merchant services, and more. No matter the customer type or requirements, U.S. Bank strives to have the right financial products available.

With thousands of branch locations and ATMs spread across many states, U.S. Bank maintains a substantial physical presence across much of the Midwest and Western United States. This extensive regional network ensures customers have convenient access to their accounts and personalized service from bankers who understand the specific dynamics and demands of their local communities.

Customers appreciate being able to conduct their banking face-to-face with representatives who are deeply familiar with the regions and neighborhoods they serve.

Beyond providing exceptional banking, U.S. Bank actively works to improve the areas it operates in. The bank supports important causes through monetary donations and employee volunteerism focused on financial literacy and education, affordable housing, small business growth, and more.

U.S. Bank strives to give back and make a meaningful difference in the lives of local residents through its community development efforts across the many regions it calls home.

Capital One offers banking options that appeal to many college students and young adults in the US. Their accounts have affordable terms and a strong mobile experience.

The 360 Checking account has no monthly maintenance fees or minimum balance requirements. This allows students flexibility to manage their money without worrying about extra costs. They also won’t get charged if their balance dips below a certain amount.

The companion 360 Performance Savings account provides good interest rates to help savings grow over time. Capital One is recognized as one of the best banks for student accounts, offering student-friendly products like the 360 Checking and 360 Performance Savings with no fees

Students can access their cash whenever needed. The rates stay competitive with other high-yield savings accounts.

Capital One’s mobile app gets praise for being intuitive and full of useful features. Through the easy-to-navigate interface, students can check balances, view transactions, transfer funds between accounts, pay bills and deposit checks simply by taking a photo.

An especially handy tool is CreditWise. The program monitors students’ credit reports and scores from TransUnion, Equifax and Experian. It provides customized recommendations and alerts about how to establish credit responsibly. This helps young adults understand the importance of credit history.

The app also allows locking and unlocking credit and debit cards instantly if they’re misplaced. An extra security feature gives peace of mind. Students receive notifications of all payment and transfer activity as well.

Capital One realizes the current generation of students and young professionals expects banking services optimized for digital and mobile use. The company focuses on continuous improvements and additions to their industry-leading mobile app.

Features like the virtual assistant named Eno demonstrate this commitment to cutting-edge technology. Eno can answer questions through conversational chat. Integrations with other popular apps give added convenience too.

Discover Bank offers many benefits for customers looking for a high-yield savings account with no fees. Let’s take a closer look at what they have to offer:

With Discover Bank, you won’t have to pay any monthly maintenance fees for your checking or savings accounts. Unlike some other banks, there are no charges each month just for having an account. This allows your money to grow without extra fees getting deducted. Whether you have a little or a lot in savings, all of it can remain working for you.

The savings account at Discover Bank pays a very competitive interest rate. This means the money in your account will earn a good return as it sits there and grows over time.

Interest rates can fluctuate at all banks depending on economic conditions, but Discover typically offers rates that are higher than the average national interest rate for savings accounts. The growing balance from interest helps offset the effects of inflation so your money maintains its purchasing power.

In addition to banking services, Discover offers a cash back rewards program on their debit card. For every $100 you spend, you’ll earn $1 back that is deposited into your savings account.

This is an easy way to get a little extra money just for paying for regular monthly expenses like groceries, gas, and utilities. The rewards add up and provide a nice boost to your savings without much effort on your part. It’s like getting small discounts on all your purchases.

Customers highly rate Discover Bank for the helpfulness and responsiveness of their customer service representatives. Service is available 24/7 by phone, online chat, email or in their branches for more complex issues.

Representatives are ready to assist with any questions about accounts, payments, transfers or other banking needs. If issues do come up, people feel confident they can be resolved quickly. Maintaining great customer service is important for building trust and loyalty with account holders.

Both the mobile app and online banking website are easy to navigate and packed with useful features. With a few taps or clicks, you can check balances, deposit checks remotely with your phone’s camera, pay bills, transfer funds and more.

Manage your money on your schedule whether you’re at home or on the go. The intuitive interfaces receive high ratings in app stores. The technology makes banking simple and accessible anytime, anywhere.

TD Bank offers many advantages that make it a great choice when you need a personal loan. With a nationwide branch network and dedication to customer service, TD Bank helps take the stress out of the borrowing process.

Customer service is a core value at TD Bank. Representatives are available around the clock by phone to answer questions about loans, payments, or anything else on your mind. Reach out online through live chat for quick responses.

For those who prefer face-to-face interactions, TD Bank has you covered. Over 1,200 stores dot the East Coast from Maine to Florida. Most branches operate extended hours on nights and weekends so you can stop by after work or on Saturdays. Friendly tellers take the time to fully explain products, rates, and your options.

With so many locations, chances are high you live close to a TD Bank. The average customer lives within 5 miles of a branch or ATM. No need to travel far just to make a deposit, payment, or apply for a loan. Everything happens close to home or work.

If you do need to go elsewhere, TD Bank has you covered with over 2,600 ATMs as well. Make cash withdrawals, deposits, and transfers 24/7 without fees when you bank with TD Bank.

The bank provides simple checking and savings accounts for everyday spending and savings goals. Earn competitive rates and avoid monthly fees by keeping minimum balances.

Get rewards with TD Bank credit cards that offer cash back on regular purchases. Use the cards to pay for emergencies until your next paycheck without paying interest.

Personal loans help pay down high-interest debt faster. Borrow amounts from $1,000 to $50,000 for any purpose. Mortgages make homeownership affordable, and investments grow long-term savings.

Beyond serving customers, TD Bank supports neighborhoods through donations, volunteering, and community programs. Financial literacy classes empower people of all ages with money management skills.

Small business development programs offer training, counseling, and loans to entrepreneurs. These efforts help strengthen local economies and improve lives. Giving back fosters goodwill and loyalty among those banking with TD Bank.

Regions Bank offers affordable options and tailored products while focusing on customers and neighborhoods.

Regions provides checking and savings accounts designed to be easy on budgets. The Regions Now Checking account charges a low $5 monthly fee that can be waived. For example, if you sign up for eStatements instead of paper, the fee is removed.

The LifeGreen Savings account has no monthly charges either if linked to a checking account. These low-cost solutions help individuals and businesses watch expenses. Customers can set savings goals without worrying about hidden fees.

In addition to checking and savings accounts, Regions offers many other financial services. They provide mortgages for home buyers with competitive rates and terms. Personal loans are available for things like home improvements or debt consolidation. Investment services let customers grow wealth for goals like retirement or a child’s education.

Small businesses get specialized checking accounts tailored to their needs, like one with higher transaction limits. Loans designed for small business uses help entrepreneurs start or expand operations. Tools to track income, expenses, and cash flow help small companies manage finances. Services are tailored so customers can find the right match for their situation.

As a leader in small business banking, Regions is committed to helping local companies succeed. Representatives provide guidance tailored to each business’s unique situation. They offer loans at competitive interest rates to help small businesses get started or grow.

Loan terms are flexible so repayment plans fit cash flow. Representatives also share knowledge on budgeting, managing expenses, and planning for the future. This personalized support aims to empower small companies and strengthen local economies.

Regions places strong emphasis on being a good community partner. Bank representatives volunteer time with nonprofit organizations that promote financial literacy and economic development. For example, they may teach classes on basic banking, budgeting, and credit.

Partnerships improve access to banking services, especially for low-income families. Through community programs, Regions works to strengthen neighborhoods and help residents achieve their goals. The bank wants to support the areas where it operates through local involvement and initiatives.

When selecting a bank, it’s important to understand the differences between savings and checking accounts to find the best fit. Here’s a detailed look at account options from several top-rated banks:

Think about what matters most like interest, fees, technology, or local branches. Online banks offer high yields while traditional banks provide personalized help. Matching your needs to the right accounts in 2024 can help you save and spend smarter.

Let’s review the most important things. We talked about many banks and what makes each one special. Every bank has different strengths.

Each person’s needs are unique. Think about what really matters to you.

Take time to compare details like account costs, interest rates, and available services for each bank. Choose the one that fits your lifestyle and financial goals best in 2025. By selecting one of the best banks in US tailored exactly for you, your money will be in good hands!

You might still have some questions about choosing the right bank. Here are answers to commonly asked things:

Some top banks known for checking accounts include Ally Bank, Charles Schwab, and Capital One 360. They offer accounts with no fees or minimum balances. Discover also gives 1% cash back on purchases up to $3,000 per month.

Online banks like Ally and Marcus by Goldman Sachs usually have the highest savings rates. But rates can fluctuate, so compare quarterly. These banks don’t charge monthly fees either.

The four biggest banks are JPMorgan Chase, Bank of America, Wells Fargo, and Citi in terms of assets and number of branches nationwide. They have locations almost anywhere but also charge monthly service fees.

Lenders like Chase, Wells Fargo and Citi often offer low rates for home loans. But keep comparing quotes from local credit unions and smaller banks too – sometimes you can do even better. Rates depend on your finances.

Banks like Bank of America, Chase, Wells Fargo and Citi provide accounts tailored for small business needs. Online branches like Axos are also popular for offering checking plus loans and credit cards.

Online banks tend to be fee-free overall. In particular, Ally Bank and Schwab don’t charge any monthly costs or ATM fees. Make sure to check account terms to avoid surprises though.

Banks like Navy Federal Credit Union and USAA are very popular for customer service. For traditional banks, Chase, Capital One and Discover usually rank highest in satisfaction surveys. Good service lets you get fast help when needed.

Well-known regional banks include PNC Bank, US Bank, Fifth Third, Huntington, and TD Bank. They operate in multiple states across regions. Customer satisfaction with these ranges from average to very good depending on location.

Online banks like Ally, Marcus, and CIT Bank consistently offer truly high yields compared to national brands. Check new account bonuses too – sometimes you can score a great rate for attracting new deposits. Rates fluctuate but online banks aim to stay competitive.

For technology and convenience, Capital One, Chase, and Schwab receive top marks. Their apps make banking, depositing checks, paying bills and money transfers very simple from phones & tablets wherever you go. Features are highly rated.